Key “Take aways”:

- Solid balance sheet

- Earnings recovered, with positive outlook.

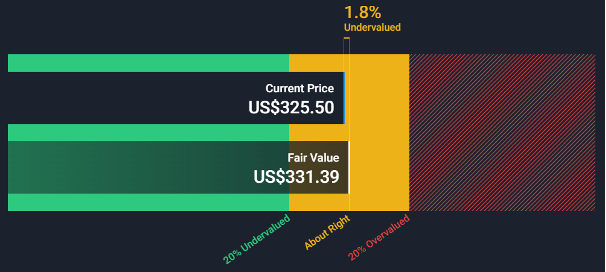

- SYK is fair priced.

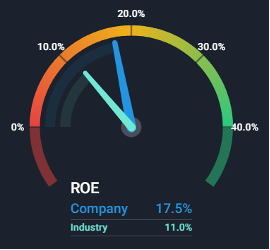

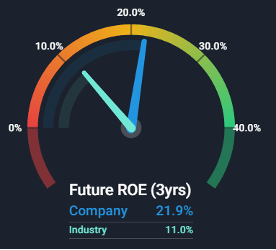

- ROE over industry average (past and future)

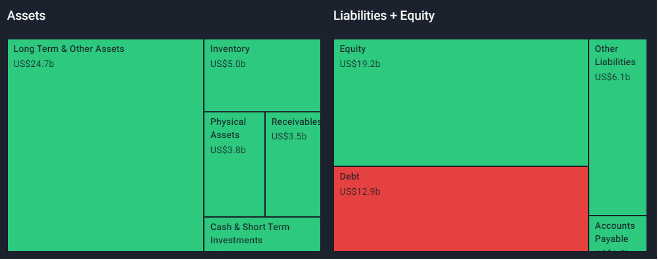

Stryker has a solid balance sheet, I always want to see more equity than debt, which is the case with $19.2b (equity) versus $12.9b (debt) and leads to a debt to equity ratio of 67%. If we even take the cash position into account, which is $2.4b, the debt may be reduced to $10.5b, and we end up with a net debt to equity ratio of 54%.

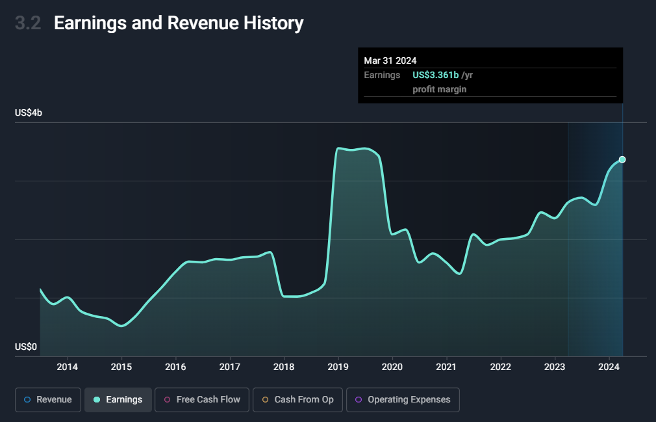

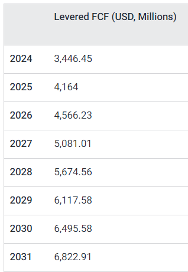

The earnings finally recovered after the drop caused by Corona pandemic, so we are in 2024 back at $3.4b of earnings.

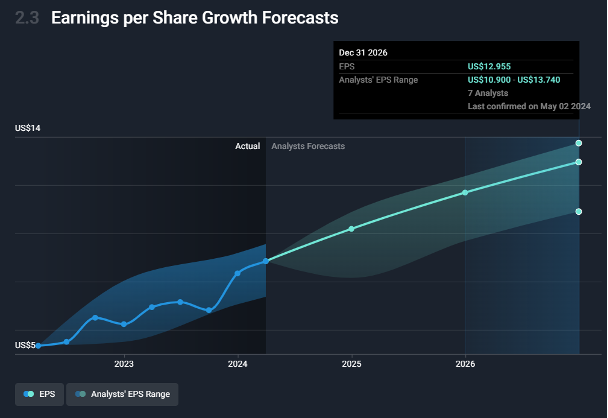

According to the analysts the positive trend should continue, with increasing EPS at an EPS Growth rate of 10.6% and an EPS E2026 of $13.

And all that we can still get at it’s fair price? What’s the catch?

The fair price is calculated on a DCF model, based on the future Free Cash Flows. I use to focus on today’s FCF compared to in 3Y:

FCF 2024: $3.5b

FCF 2027: $5.0b

And there we have it, SYK must deliver very well within the next three years.

I always have a look on return on equity ROE:

With a ROE of 17.5% and future ROE of 21.9%, my money is working well.

Future Earnings growth rate is 10.5%, ok for an easy ride.

What do you think about SYK? Would you invest in SYK?

PS: The risk alert from the tool “significant insider selling over the past 3 months” is no risk at all. The seller is not from management, it is Ronda Stryker, a grand child of the founder.

Source of pictures: https://simplywall.st/

Fair Value: Fair Value: With 6% return p.a. and discount rate of 6%, I get a fair value of $323.