My main narrative for FRE:

- What former CEO Mark Schneider blow up to an inefficient giant, will now be cut down by actual CEO Michael Sen and trimmed on efficiency

- from formally 4 segments FMC (dialyses), Helios (private hospitals), Kabi(Generic & Infusions), Vamed (Projects & Digitalization) only 2 remain: Helios, Kabi, the other will be sold, and the intakes will help to restructure the financial situation

- under Mark Schneider the Spanish hospitals were acquired, this was a good deal: privat hospital runs well in Spain, because of their good reputation wealthy Latin Americans travel for medical treatments to Spain

I focus also on:

- More equity than debt. Ratio is at 62% (debt/equity). So fine.

- A ROE of about 20%. Past 1%, future 8%. For me still to low.

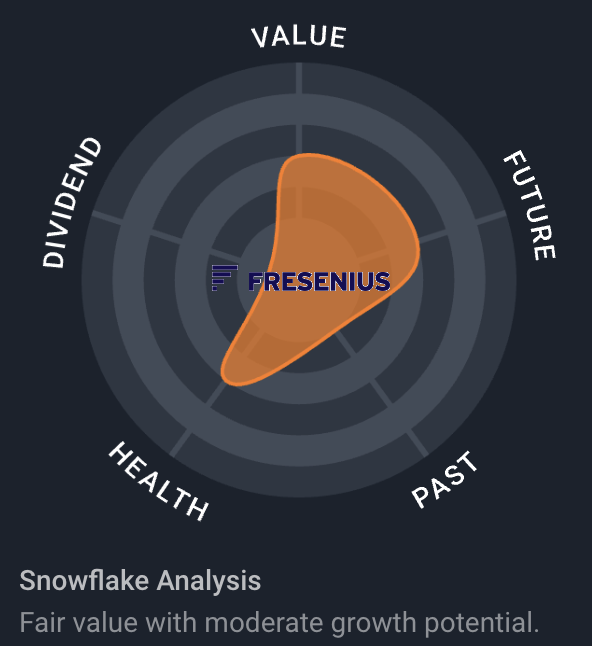

Actually it is 61% under fair value (FV $74), with moderate underlaying FCF

- 2024: €1.500m

- 2027: €1.600m

These are the type of investment cases I like, the market sees a catastrophic situation (therefore 61% under fair value), I believe they fix it. First comes the pain, then the money.

See my narrative on Simply Wall Street (Pseudonym Tokyo):

https://simplywall.st/narratives/first-comes-the-pain-then-the-money